Raiding A Roth Early? No Woes

Published Friday, February 20, 2015 at: 7:00 AM EST

What happens if you take funds out of a Roth IRA well before retirement? The tax ramifications might not be particularly dire. Early payouts are frequently tax-free, or mostly tax-free, even if you don't meet the requirements for "qualified" distributions.

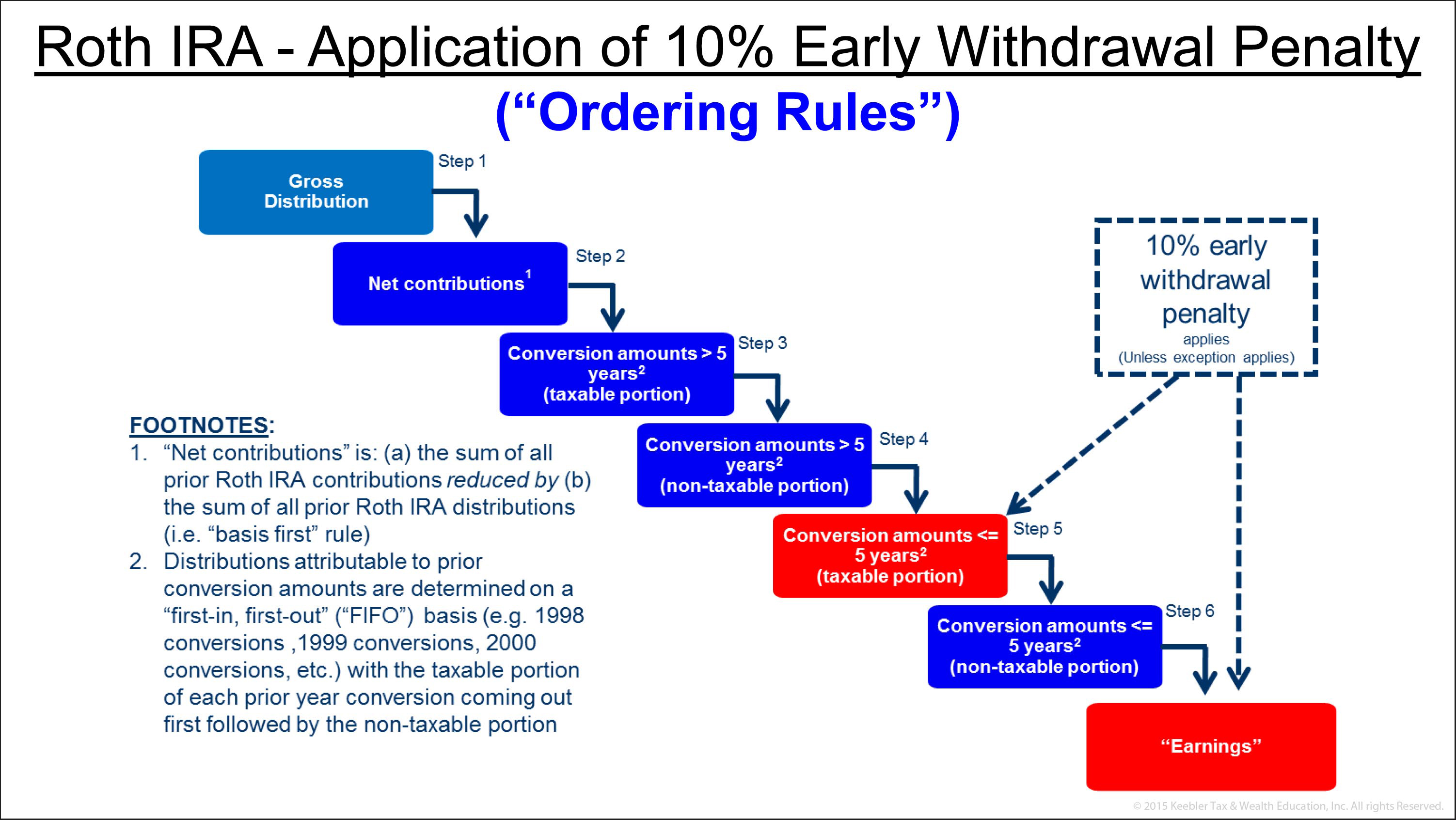

It all has to do with the "ordering rules" for Roth IRAs. It's important to get a firm grasp on these rules so you can plan your withdrawals accordingly.

It all has to do with the "ordering rules" for Roth IRAs. It's important to get a firm grasp on these rules so you can plan your withdrawals accordingly.

Contributions to a Roth IRA are never tax-deductible, but qualified distributions are tax-free. For this purpose, "qualified" means withdrawals made from a Roth you've had for at least five years if you've reached age 59½; the payout is because of your death or disability; or you use the funds to pay qualified homebuyer expenses (up to a $10,000 lifetime limit).

But sometimes you just can't wait until age 59½ or for the Roth IRA to hit the five-year mark. In this case, and assuming you don't have another viable alternative, you can raid the Roth for the funds you need. Is it a tax disaster? Not usually. The tax is computed under generous rules that can save you from owing anything. Specifically, distributions from a Roth IRA are treated as if they occurred in the following order:

- Roth IRA contributions. Because you didn't get a tax break when you put in this money, you aren't taxed when you withdraw it.

- Contributions from converting a traditional IRA into a Roth. The same principle applies here. Because you already were taxed on the distribution from the traditional IRA that went into your Roth, you can take out those funds without being taxed again.

- Contributions from converting nontaxable traditional IRA balances into a Roth. These, too, aren't subject to regular tax when you withdraw them from the Roth.

- Roth IRA earnings. These, finally, are taxable when withdrawn unless they meet the definition of qualified distributions.

These ordering rules can work in your favor. For example, suppose you have $100,000 in a Roth you established four years ago -- $25,000 in contributions, $50,000 in taxable conversions, $15,000 in nontaxable conversions, and $10,000 in earnings. If you withdraw $35,000, the distribution is treated as having come from the $25,000 in contributions and $10,000 from taxable conversion contributions. So the entire payout is tax-free even though it isn't a qualified distribution.

Note that you'll have to pay tax at ordinary income rates for nonqualified distributions. In addition, there's normally a 10% tax penalty on such withdrawals made before age 59½.

Remember that withdrawing funds early from a Roth IRA isn't optimal, because it reduces the amount you'll have available in the future. However, it's comforting to know that you may be able to pull out cash tax-free if you need to.

© 2024 Advisor Products Inc. All Rights Reserved.